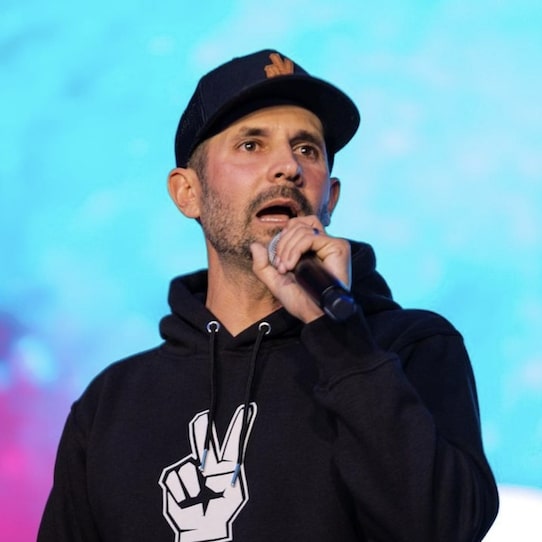

Subto specialist Pace Morby can’t tell you whether or not the real estate market’s gonna be brought to its knees or not, but what he can tell you is he’s switching up his approach. See, Pace wholesales, he does fix and flips, as well as buy and holds. And, fix and flips, especially, have seen a massive slowdown so far in 2022. And it’s probably only gonna get worse. So what’s his plan? How’s Pace gonna tweak his investing strategy during this recession? Read on.

“Here’s the thing,” Pace says, “I’m gonna fix and flip a lot less. The number one group of people that got their butts handed to ’em in the real estate market crash of 2008, 2009, and 2010? Were people that were fixing and flipping. And why is that? It’s because they bought a house for $200,000, put $40- or $50,000 into it, hoping to sell it for well above $300,000 and make a profit. But if the market crashes before you get it sold, you now have a really expensive short-term loan on this property. Interest only, every single month.”

“And then,” he continues, “by the time you do your renovations and get it listed, it’s now barely worth what you bought it for. And you got employees and all these short-term loans, credit cards, lines of credit, and all this over-leverage which makes you susceptible to market changes. So I’d recommend you pull back on fix and flips and if you do do them, just be very selective about the types of deals that you even allow into your pipeline. Take a very conservative approach.”

The second adjustment Pace is making during this recession is he’s focusing even more on creative finance deals. For example, he just scored a 40-unit apartment complex in San Angelo, Texas. He’s acquiring the entire thing using seller finance. Meaning, no loan, no downpayment, really great terms associated with it, and, the rent rate is under market value. So there shouldn’t be any issue with vacancies. And speaking of apartments, think about it, probably a safer bet than single family homes right now.

Why’s that? Well, foreclosures are up 700% since the start of the year. And when these poor people get kicked outta their homes, where do they go? They go look for an apartment, don’t they? It’s more affordable, there’s less utilities to pay for, very little upkeep, maybe it’s even closer to where they work, right? “So as the market softens and maybe we’ll even have a downturn,” Pace explains, “I will still buy properties that are focused on affordable housing: things that are under the average rent rate.”

“The third thing I’m doing,” continues Pace, “is if I stay at 40 units or larger in the multifamily space, and all of a sudden 20% of my tenants lose their job because of some horrible downturn, the reality is 20% of 40 is only eight. So I would still have 32 tenants shouldering the burden, making the payments, covering my mortgage, covering the utilities, the upkeep of the property. Yeah, my cash flow would be significantly damaged, but I would be able to still hold onto my property.”

“Hopefully those three tips help you and tell you exactly, very specifically, what I will be doing over the next 12 to 24 months, depending on what happens with interest rates. If they come back down, you’re gonna see the market accelerate again. But the people that are saying we’re not having a correction? They are obviously not in the real estate game. I am in the game. Our listings are taking longer to sell. It is starting to get scary. So you better learn about creative finance. Because now’s the time to use it.”